Options Portfolio

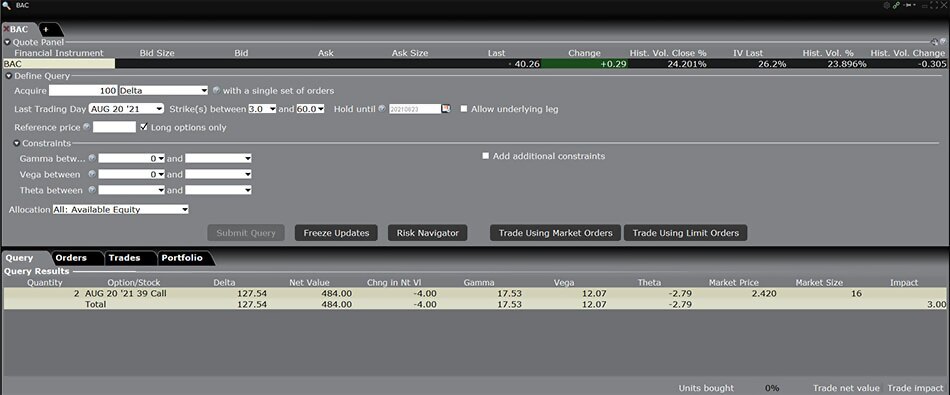

Use the TWS Option Portfolio tool to help you adjust the risk profile of your portfolio by any of the Greek risk dimensions. Find the most cost-effective way to achieve your objective in Delta, Gamma, Vega or Theta by describing your objective and specifying any conditions.

- With access to complete and comprehensive real-time options market data, the Option Portfolio algorithm finds the most cost-effective solution to achieve your desired objective, considering both commissions and premium decay.

- To ensure the solution list is relevant based on changes in the market, the algorithm continually searches the market and presents the best solution list every 30 seconds.

- Change any of your query criteria at any time. The algorithm automatically restarts using the revised constraints and presents an updated solution list.

- The Option Portfolio integrates seamlessly with our sophisticated real-time risk management platform, the IB Risk Navigatorsm. With the click of a button you can see how trading the algorithm's solution will affect your overall risk summary.

- Available for US Stocks and Indexes.

USER GUIDES

Get Started with the Options Portfolio

For more information on using the Options Portfolio, select your trading platform.

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options Clearing Corporation risk disclosure document titled Characteristics and Risks of Standardized Options by clicking here.